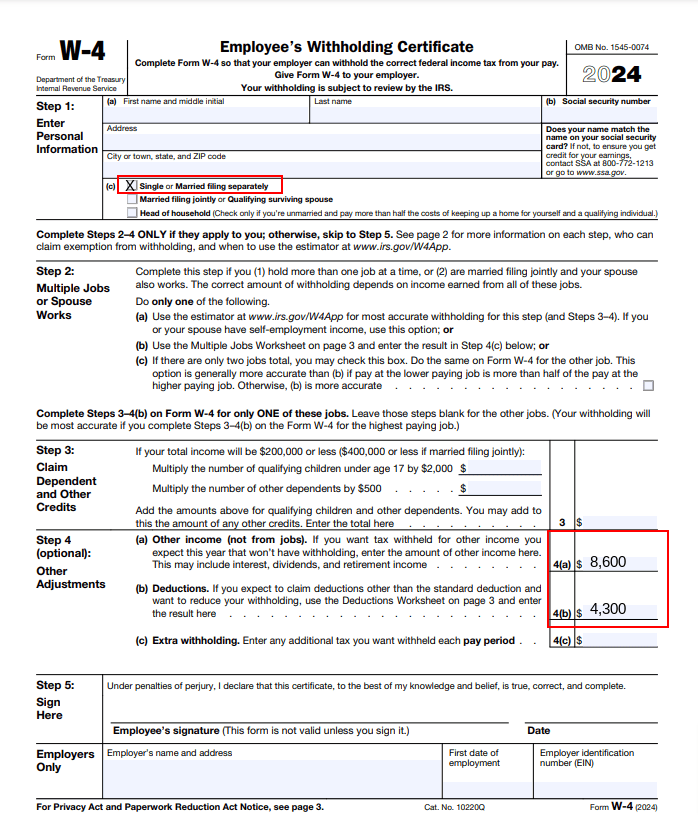

New W-4 Forms For 2024 Employees – A Form W-4 is a tax document that employees fill out when they begin a new job. It tells the employer an updated version of Form W-4 for 2024, which can be used to adjust withholdings on . Below are three sets of tax figures in 2024 that all employees should to the information on your Form W-4. The IRS recommends that you consider completing a new Form W-4 whenever your .

New W-4 Forms For 2024 Employees

Source : www.irs.gov2024 New Federal W 4 Form | What to Know About the W 4 Form

Source : www.patriotsoftware.com2024 Form W 4P

Source : www.irs.govHere’s How to Fill Out the 2024 W 4 Form | Gusto

Source : gusto.comHow to Fill Out the W 4 Form (2024) | SmartAsset

Source : smartasset.comHere’s How to Fill Out the 2024 W 4 Form | Gusto

Source : gusto.comWhat Is the W4 Form and How Do You Fill It Out? Simple Guide

Source : smartasset.comHere’s How to Fill Out the 2024 W 4 Form | Gusto

Source : gusto.comW4 Form 2024 | Filling out the W 4 Tax Form | Money Instructor

Source : m.youtube.comForm IT 2104 Employee’s Withholding Allowance Certificate Tax Year

Source : www.tax.ny.govNew W-4 Forms For 2024 Employees Employee’s Withholding Certificate: IRS document completed by employees. The W-4 Form, issued by the IRS, is a critical document for determining the amount withheld from your paycheck for federal income taxes. Its accurate completion is . Paper forms should be sent to the SSA by the end of February. When a new employee is hired, she is typically asked to complete a Withholding Allowance Certificate, known as a W-4 form. This form .

]]>